- Abercorn Oil Co.

- Adam & Hamilton

- Airdrie Mineral Oil Co. Ltd.

- Alan Craig & Sons

- Alexander Law & Co.

- A.M. Fell & Co.

- Andrew Spencer (firm)

- Andrew Taylor (firm)

- Andrew Walker & Sons

- Annick Lodge Oil Co.

- Annick Lodge Oil Co. Ltd.

- Archibald Finnie & Sons

- Archibald Hood

- Auchinheath Chemical Company

- Avonhead Coal Company

- Bain & Carlile

- Bain & Drummond

- Bathgate Oil Co. Ltd

- Benhar Coal Co. Ltd.

- Binnend Oil Co. Ltd.

- Blackburn Mineral Oil Co.

- Blackston Mineral Oil Co.

- Bredisholm Oil Co.

- British Oil & Candle Co. Ltd.

- Broxburn Oil Co. Ltd.

- Broxburn Shale Oil Co. Ltd.

- Burntisland Oil Co. Ltd. (1881)

- Burntisland Oil Co. Ltd. (1893)

- Cairns & Co.

- Calder Oil Co.

- Caledonian Mineral Oil Co. Ltd. (1889)

- Caledonian Mineral Oil Co. Ltd. (1898)

- Caledonian Oil Co.

- Capeldrae Coal & Oil Co. Ltd.

- Cawburn Oil Co.

- Cityside Coal & Oil Co.

- Clarkson & Spence

- Clippens Oil Co. Ltd. (1878)

- Clippens Oil Co. Ltd. (1893)

- Clippens Shale Oil Co.

- Clydesdale Chemical Co.

- Coatbridge Oil Co.

- Crofthead Oil Co.

- Dalmeny Oil Co. Ltd. (1871)

- Dalmeny Oil Co. Ltd. (1896)

- Dalserf Coal, Coke & Oil Co. Ltd.

- Daniel Wylie & Son.

- David Hamilton & Co.

- Dickson Candle Co. Ltd.

- Douglas & Boag

- Dr. James Steele (firm)

- Drumgray Coal Co.

- Dundas Shale Oil Co.

- East Hermand Shale Co.

- Eldin Oil Co.

- E. Meldrum & Co.

- E.W. Binney & Co.

- E.W. Fernie & Co.

- Fraser & Meikle

- George Gray

- George Hutchison & Co.

- George Miller & Co.

- George Shand & Co.

- Glasgow Oil Co. (Broxburn) Ltd.

- Glentore Mineral Oil Co. Ltd.

- Hamilton, McCulloch & Co.

- Henry Tod (firm)

- Hermand Oil Co. Ltd (1885)

- Hermand Oil Co. Ltd (1890)

- Holmes Oil Co. Ltd.

- Inverkeithing Oilwork Co.

- James Anderson & Son

- James Gemmell

- James Greenshields & Son

- James Liddell & Co.

- James Miller

- James Miller, Son & Co.

- James Nimmo & Co.

- James Palmer & Co.

- James Ross & Co.

- James Ross & Co. (Philpstoun Works) Ltd.

- James Struthers & Co.

- James Young & Co.

- J & E Robinson

- John and James Baird

- John Baird

- John Barr & Co.

- John Miller & Co.

- John Nimmo & Son

- John Poynter & Son

- John Robertson Junior & Co.

- John Vallance & Co.

- John Watson & Sons

- John Wield (firm)

- J.P. Raeburn

- Kirkliston Oil Co.

- Lanark Oil Co. Ltd.

- Leavenseat Oil Co.

- Lester, Wyllie & Co.

- Lochgelly Iron & Coal Co.

- McNaughton & Aitken

- Methil Paraffin Oil Co.

- Mid-Calder Mineral Oil Co. Ltd.

- Midlothian Mineral Oil Co. Ltd.

- Midlothian Oil Co. Ltd.

- Monkland Iron Co. Ltd.

- Monkland Oil & Coal Co. Ltd.

- Monkland Oil Refining Co. Ltd.

- Mungle & Thornton

- New Hermand Oil Co. Ltd.

- Nish, Gibb & Co.

- Nitshill & Lesmahagow Coal Co.

- North British Oil & Candle Co. Ltd.

- Oakbank Oil Co.

- Oakbank Oil Co. Ltd.

- Oakbank Oil Co. Ltd. (1868)

- Peter Drummond

- Peter Scott (firm)

- Pirnie Coal Co.

- Pumpherston Oil Co. Ltd.

- Pumpherston Shale Oil Co.

- Raebog Oil Co.

- Rankine & Mitchell

- Robert Bell & Co.

- Robert Binning & Co.

- Robert Galloway & Co.

- Robert Steuart & Co.

- Robinson, Donald & Co.

- Rowatt & Yooll

- Scottish Mineral Oil & Coal Co.Ltd.

- Scottish Oil Co. Ltd.

- Scottish Oils Ltd.

- Seafield Patent Fuel Co.

- Shettleston Oil & Chemical Co. Ltd.

- Smith Brothers & Muurling

- South Cobinshaw Oil Co.

- Stanrigg Oil Co.

- Straiton Estate Co. Ltd. (Straiton Oil Co. Ltd)

- Tarbrax Oil Co. Ltd.

- Thomas Carlile & Co.

- Thomas Hutchison

- Thomas & James Thornton

- Thomson, Lockhart & Co.

- Uddingston Oil Co.

- Uphall Mineral Oil Co.

- Uphall Mineral Oil Co. Ltd.

- Uphall Oil Co. Ltd.

- Walkinshaw Oil Co. Ltd.

- West Calder Oil Co.

- West Calder Oil Co. Ltd.

- Westfield Oil Co. Ltd.

- West Lothian Oil Co. Ltd

- West Lothian Oil Co. Ltd.

- Westwood Oil Co.

- William Black & Sons

- William Black & Sons Ltd.

- William Brown & Co.

- William Fraser & William Fraser junior

- William M'Lintock & Co.

- William Taylor & Co.

- W. & T. Kelt

- Young's Paraffin Light & Mineral Oil Co. Ltd.

Linlithgow Oil Co. Ltd.

122 George Street, Edinburgh (from 26th April 1884)

4a St Andrew's Square, Edinburgh (from 16th January 1886)

123 Hope Street, Glasgow (from 10th October 1890)

7 Royal Bank Place, Glasgow (from 16th November 1896)

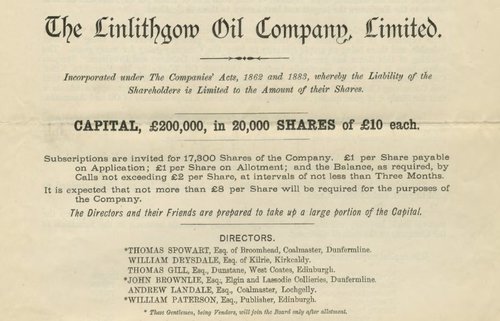

The Linlithgow Oil Company Ltd was one of a number of new oil enterprises established during the prosperity of the early 1880's, inspired in part by the success of the Broxburn Oil Company Ltd. The promoters of the Linlithgow Oil Company were mainly Fife coalmasters including Andrew Landale, previously a director of the Capeldrae Coal and Oil Co. Ltd. The company set out to exploit reserves of shale in the Ochiltree and Champfleurie estates to the east of Linlithgow - the first time that shale had been worked in the lands north of the Bathgate Hills. These seams were described in the company prospectus as being similar to those worked profitably at Broxburn and Dalmeny, and the decision was made to adopt the Henderson retort, which had been critical to the success of the Broxburn company, rather than the more modern Young and Bielby retort that was being adopted by most other new works at that time.

The Company's operations were planned on an ambitious scale with a share capital of £200,000. This funded the construction of a crude oil works and refinery at Champfleurie, coal and shale mines, housing at Kingscavil and Bridgend, a four mile branch railway, and the lease of Champfleurie House with associated shootings. The refinery was built with a generous capacity and from the outset crude oil from other companies was processed alongside the output of Champfleurie crude oil works. Initially crude oil bought from Young's Paraffin Light & Mineral Oil Company Ltd was processed; later the works were to refine much of the output of Holmes and Breich oil works. A candle works were added to the refinery soon after opening.

The decision to adopt the Henderson retort proved an unfortunate mistake. The local shales proved less rich in oil that those of the Broxburn area, or had been anticipated in early tests. While the Henderson retort extracted slightly more oil that the Young and Bielby retort, it failed to recover much of the ammonium sulphate which became the major source of profit from shale. By the time this was recognised and acknowledged, the company had little remaining capital to replace retorts and efforts to raise additional capital through preference shares met limited success.The company paid a 10% dividend on ordinary shares in 1885, but no dividend was declared throughout the rest of the company's existence.

The company continued piecemeal repairs and experimental improvements to the existing retorts for many years, but by the turn of the 20th century these were worn out. The failure to raise capital to construct new, efficient retorts ultimately led to the collapse of the company. The Linlithgow Oil Company's problems also affected crude oil suppliers - the Holmes Oil Company Ltd closed in 1901 and the New Hermand Oil Company Ltd collapsed in 1903. Many of the mineral rights of the Linlithgow Oil Company were acquired by James Ross & Company and mining resumed to supply shale to the Philpstoun Oil Works.

- THOMAS SPOWART, Esq., of Broomhead, Coalmaster, Dunfermline

- Board member 1884- 88, Chairman 1885-88

- ANDREW LANDALE, Esq., Coalmaster, Lochgelly

- Board member 1884-1902, Chairman 1888-1900

- WILLIAM DRYSDALE, Esq. of Kilrie, Kirkcaldy

- Board member 1884-?

- Dr. ARTHUR DRYSDALE, Esq. Dunfermline

- Board member 1895 -1902, CHAIRMAN 1900-1902

- THOMAS GILL, Esq., Dunstane, West Coates, Edinburgh

- Board member 1884-?

- JOHN BROWNLIE, Esq., Elgin and Lassodie Collieries, Dunfermline

- Board member 1884-1902

- WILLIAM PATERSON, Esq., Publisher, Edinburgh

- Board member 1884-?

- Sir CHARLES TENNANT, Baronet, The Glen, Innerleithan

- Board member 1890-1902. Sir Charles Clow Tennent (1823-1906), Scottish businessman, industrialist and Liberal politician. President of the United Alkali Company and Chairman of the Union Bank of Scotland, Grandson of chemist and industrialist Charles Tennant

- ROBERT RUSSELL PRENTICE, 6 Mayfield Terrace, Edinburgh, Retired Farmer

- Board Member ?-1902

- JOHN YOUNG, Duntrane, Bearsden, Manager

- Served as Company Secretary prior to election to the Board 1900-1902

- JAMES SNODGRASS

- Recruited as Works Manager c.1890, but left the company's employment c.1892 following blame for major deficiencies in operating practice. Described as "a trained chemist who came with a good reputation". A James Snodgrass is a named as works manager of the Caledonian Mineral Oil Company Ltd's Tarbrax Oil Works in a description published in April 1890

- JAMES BEVERIDGE

- Previously Mining Manager, appointed as Works Manager c.1892 following the departure of James Snodgrass. A photograph of James Beveridge and his wife Margaret is held in the collection together with a tray presented to him by the Chamfleurie and Ochiltree Workmen's Friendly Society

Officers

Shareholders

List of principal shareholders according to the last list lodged with the Registrar of Joint Stock Companies prior to suspension of shares - Reproduced in The Scotsman, 5th February 1902.

ORDINARY SHARES - number of shares

Charles Anderson, Fettykill, Leslie, Papermaker - 240

William W. Anderston, Greenside, Edinburgh, bank agent - 170

John Brownlie, Lassodie, colliery manager - 280

Dr. Broadfoot, 6 West Blacket Place, Edinburgh - 100

William Bissett and another, 47 Hollybank Terrace, Edinburgh - 150

J. Balmain and another, British Linen Bank, Glasgow, agent - 200

R. Cox (Cheine & Tait), 67 George St. Edinburgh - 512

Adam Clapperton, Gorebridge, merchant - 280

Thomas W. Clapperton, W.S., 4a St Andrew's Sq. Edinburgh - 150

James Dewar, Lassodie - 72

Arthur Drysdale M.D., Dunfermline - 212

Mrs R. Dennis, Brixwold, Bonnyrigg- 100

A. Drysdale, surgeon, and others, Dunfermline - 480

Mrs Jane Easton, The Square, Penicuik - 110

A.D. Ferguson, Pentland View, Dunfermline - 75

Alexander Fraser, Violet Bank, Dunfermline - 337

William Fraser, 47 Maxwell Drive, Pollockshields - 196

D. Ferguson and another, 191 Ingram St. Glasgow - 250

Thomas Gill, West Coates, Edinburgh - 100

Thomas Gilles, Woodside, Linlithgow - 100

R. Gourlay and another, Bank of Scotland, Glasgow - 90

R. Gilmour and another, 18, St Andrew's Square, Edinburgh - 90

James Haldane, 24 St Andrew Square, Edinburgh - 72

James Houston, Marchfield House, by Dumfries - 100

Captain A. Howling, 24 Albany St. Leith - 230

D.R.W. Huie and others, Royal Bank of Scotland, Edinburgh - 430

C.H. Cuthbertson, 92 St Vincent St. Glasgow - 140

David Hamilton, 224 St vincent St. Glasgow - 100

James Inglis, Margate St. Dunfermline - 160

Rev. D.B. Jardine, Thornhill - 202

James Lindsay, 20 Market St. Edinburgh - 80

Andrew Landale, coalmaster, Dunfermline - 202

William Leishman and others, Cauldie House Linlithgow - 143

Mrs George Leishman, W. Newbigging, Norham - 90

James Lindsay, Drydenbank, Loanhead - 250

Alexander Mathewson, Constitution Rd. Dundee - 100

James Martin, Priestfield, Ladybank - 80

Henry Mungall, 20 Royal Terrace, Edinburgh - 115

R.T. & A.J. Moore, 156 St Vincent St. Glasgow - 350

Edward Maughan, 5 Randolph Terrace, Edinburgh - 70

James McRosty, solicitor, Crieff - 70

J.A. Nasmyth, coalmaster, Dunfermline - 100

R.R. Prentice, 6 Mayfield Terrace, Edinburgh - 280

John Paton, Tillicoultry - 150

Gavin Paul, &, Ravelstoun Park, Edinburgh - 100

Lord Roseberry, Dalmeny Park, Edinburgh - 500

Walter G. Rough, 24 George Square, Glasgow - 150

Alexander Rennie, Sandbridge Villa, Innerleithan - 100

William Stewart, St. Mary's St Kirkcudbright - 200

Rev. R.D. Shaw, Lauder Rd. Edinburgh - 70

John Saunders, 71 High St. Dunfermline - 200

James T. Smith, Dulloch, Inverkeithing - 2472

J.M.S. Shaw, 18, St Andrew's Sq. Edinburgh - 180

Francis J. Tennant, Hindford House, North Berwick - 126

Sir Charles Tennant, The Glen, Inverkeithing - 1455

Robert Thomson, 34 Upper Kirkgate, Aberdeen - 205

David J. Wilson, Bank of Scotland, Perth - 127

Wilfred Williams, 52, Newhall Street, Birmingham - 150

Peter Wilson, Broxburn - 262

James Wood, 28 Royal Exchange Square, Glasgow - 100

PREFERENCE SHARESNUMBER OF SHARES

Charles Anderson of Fettykil, Leslie - 420

James Anderson, North, Leven- 300

Edward Bruce, W. Mayfield, Edinburgh - 294

John Brownlie, Lassodie, Dunfermline - 405

John Christie, 8 North Lindsay St. Dundee - 201

John H. Cooper and another, Commerial Buildings, Dunblane -250

Charles Carlow, 20 Eglinton Crescent, Edinburgh - 70

Mrs. E.L. Dods, Hedderwick, Dunbar - 105

James Dalrymple, Woodhead, Kirkintilloch - 140

John Dennis, Dalkeith - 300

Arthur Drysdale M.D., Dunfermline - 1994

Thomas Gill, W. Coates, Edinburgh - 175

Henry Gourlay, Bank of Scotland, London - 140

Hugh Gilmour, 18, St Andrew's Sq., Edinburgh - 709

James Haldane, 24, St Andrew's Sq., Edinburgh - 126

Rev J.B. Jardine, Thornhill - 126

W.F. King, Russell Place, Trinity, Edinburgh - 150

David Lamont, Dunfermline - 100

William Leishman, Islington, London - 200

Andrew Landale, Coalmaster, Dunfermline - 220

William Mercer, Rose Place, Earlston - 125

Dr. James Morris, Dunfermline - 175

Henry Monteith 39, Castle St. Edinburgh - 150

Alexander Mathewson, Terrace House, Dundee - 175

R.T. & A.G. Moore, 155 St Vincent St.n Glasgow - 613

Robert Morrison, Accountant, Perth - 149

James McFarlane, Canmore St. Dunfermline - 370

William McLellan, Morningside, Edinburgh - 2300

James A. Nasmyth, Middlebank, Dunfermline - 175

James Ogston, Norwood, Aberdeen - 100

James Paton, 177 Bruntsfield Place, Edinburgh - 100

James Paton, Tillicoultry - 600

John Paterson and brother, 42 Blacket Place, Edinburgh - 300

Robert R. Prentice, 6, Mayfield Terrace, Edinburgh - 333

John Paterson , 42 Blacket Place, Edinburgh - 100

A.F. Roberts, Thornfield, Selkirk - 200

David Russell, Silverburn. Leven - 500

Lord Roseberry, Dalmeny - 1465

C.S. Romanes, 50 Frederick St. Edinburgh - 200

Christian Salvesen, 29 Bernard St., Leith - 300

James T. Smith, Dulloch, Inverkeithing - 4425

E.T. Salvesen, 40 Drumsheugh Gardens, Edinburgh - 100

John Sanders, 71 High St. Dunfermline - 100

R.H.J. Stewart of Physgil, Wigton - 505

Robert Tullis, Auchmuty, Markinch - 500

Sir Charles Tennant. The Glen, Innerleithen - 4000

Mrs R. Wilson, Maxwelltown - 250

J.L.W. Watt & Sons, Partickhill, Glasgow - 125

John Young, 7 Royal Bank Terrace, Glasgow - 100

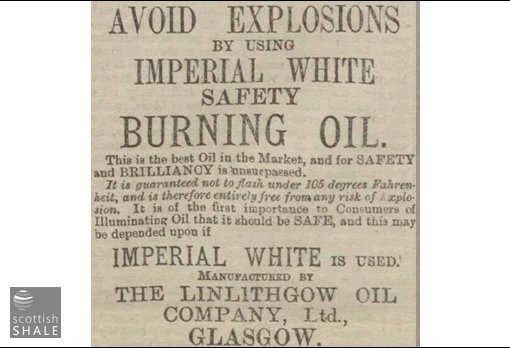

It was announced at the 1886 AGM that "agents had been appointed in Ireland and England, as well as Scotland", but nothing more is known of these arrangements. Throughout the 1890's advertisments appeared in Scottish provincial newspapers for "Imperial White safety burning oil".

Advertisment from The Falkirk Herald, 3rd January 1894

Prospectus of the Linlithgow Oil Company Ltd, dated September 1883

Registration Records transcribed from dissolved company records held by the National Archives of Scotland.

- 1885 AGM - Two shale mines, a colliery, four benches of retorts, and the mineral railway were now in operation, 112 houses (at Kingscavil) had been built and the refinery was under construction.

- 1886 AGM - Sales agents had been appointed throughout Britain, consideration was being given towards establishing a candle works. A dividend of 10% announced

- 1887 AGM - Market conditions were difficult due mainly to overseas competition; a wax sweating plant was now complete and candles were being produced

- 1888 AGM - Conditions remained difficult throughout the industry and much production had been lost to strikes. Agreement over the market price of wax was a cause for optimism - a new mine had been sunk to the Dunnet shale

- 1889 AGM - It was recognised that the continued use of Henderson retorts was limiting the income from sale of Ammonium Sulphate. A shareholder's committee would investigate the situation.

- 1890 EGM - The shareholder's committee report that construction of new Young and Bielby retorts was the only sensible course of action. There were calls that Sir Charles Tennant become Chair

- 1890 AGM - Two benches of Young and Bielby retorts were to be constructed. Sir Charles Tennant joins the board and appoints as advisor, William Fraser of the Pumpherston Oil Company Ltd. Company offices had been moved from Edinburgh to Glasgow

- 1891 SGM - A meeting to call for additional capital

- 1891 AGM - The new retorts were increasing ammonium sulphate yields, market conditions were improving, but savings were needed in the cost of production and further working capital was required.

- 1892 AGM - The expectations of the previous year had been unfulfilled. The Works Manager was blamed for the shortcomings and had been replaced. A shareholder described the company as a disgrace.

- 1893 AGM - The market was depressed due to the collapse of the Mineral Oil Association, but conditions were improving and the works were in good order

- 1894 AGM - Market conditions continued to deteriorate

- 1895 AGM - A small surplus had been made, but no dividend declared. The coal-miner's strike had added considerably to costs

- 1896 AGM - There had been an improvement in prices, but the volume of materials sold had declined

- 1897 AGM - A loss was announced due to the low prices of ammonium sulphate and wax products, however savings were being made in wages and royalties paid.

- 1898 AGM - Market conditions remained depressed, but it hoped to operate without a loss that year. Improvements made possible by adoption of Bryson or improved Henderson retorts were being considered.

- 1899 AGM - Continuing market difficulties and the company had been unable to install new retorts, unlike many of its competitors

- 1900 AGM - A net profit had been achieved for the year, and an experimental set of retorts were to be built and, in response to rising coal prices, the company would re-open the Houston Coal.

- 1901 AGM - It was warned that the future of the company was bleak unless retorts were completely renewed.

- 1902 Circular - Calling an extraordinary general meeting to consider wind-up of the company.

Outline

1885 Annual General Meeting

The first annual general meeting of the shareholders of the Linlithgow Oil Company, Limited, was held yesterday in Dowell's Rooms. Edinburgh - Mr Thomas Spowart, chairman of the company, presiding. There was a good attendance. The report, which was held as read, stated that the directors had to congratulate the shareholders on the progress that had been made in the opening and fitting of the shale and coal mines, and also in the erection of the plant and machinery required for the works. Regarding the erection of the works and machinery, the directors had exercised considerable care, visiting the works frequently, and taking a personal supervision of the contracts and accounts. The retorts and refining works had been erected with all the most recent improvements, and meantime were capable of distilling 250 tons of shale, and of refining the products of 500 tons of shale daily. The two shale mines now completed were capable of yielding an output of over 500 tons per day. After mature deliberation, the directors resolved to have direct railway communication with the works, and a line had now been constructed which intersects the whole mineral fields belonging to the company. Acting on the principle which they were assured would be commended by the shareholders as judicious, the directors had not taken credit for the value of the stock of shale or coal which was on hand at 31st March, when the balance-sheet was made up, in a revenue account, but had credited capital with the value of these; due provision being thus made for any possible depreciation on the plant or on the minerals worked. The report then proceeded to refer to the proposed issue of the remaining 6000 shares of the company, which the directors recommended should be issued pro-rata to the existing shareholders at par.

The Chairman, in moving the adoption of the report, said he had to congratulate the shareholders on the progress the works had made since last year. They had had some few little difficulties to contend with, but none of them of a very serious character. The chief difficulty was the railway - opening up the works with the North British system at Linlithgow. The failure of the health of the contractor caused a delay of about three months, but now they had got their line completed by Messrs Stratton. It extends to nearly four miles, and was a very heavy part of the undertaking; but they could not avoid it, and they now had the advantage of having their fields opened up by a line belonging to themselves, thus securing a better outlet at more moderate rates than they otherwise could have been obtained. The railway had been open since May and was working most satisfactorily. The mineral field, which was the most important part of the whole business, had turned out entirely satisfactory. They had two, mines in full operation- one; on the estate of Champfleurie, and the other on the estate of Lord Rosebery at Ochiltree. These had been in operation for a long time. He then went on to quote from a report which the directors had obtained from Messrs Landale, Frew & Landale, mining engineers, during this mouth. It stated that one of the mines was capable of raising 350 tons of shale per day. The thickness of the shale in the two mines at present in working order is 6ft. 3in. and 6ft. They had now a colliery on the Ochiltree property, from which they expected to be able to supply the present necessities of the works in the way of fuel. That was a very exception thing regarding an oil work; but he was glad to be able to say that they were able to get coal, which meant a very considerable saving to them. (Applause.) They had four benches retorts going, and they had made arrange with Young's Company to take their crude oil. It a very good certificate as to the quality of their crude when Young's people said they wished a very much larger supply. (Applause.) They had also sold sulphate of ammonia. The refinery being erected would, he thought, be ready, with good weather, in October. The two shale mines were capable of yielding 500 tons per day; the crude shale retorts were capable of producing 250 tons per day; and their own refinery would be capable of refining 500 tons per day. (Applause.) He then adverted to the proposal by the directors to issue the remaining shares, remarking that, as they only intended to call up £8 as in the case of the existing shares, they would then have an uncalled capital of 240,000, while their borrowing powers would remain intact.

In conclusion, the Chairman said that they had 112 houses at their Champfleurie works, and they were about to erect others on the Ochiltree property. Mr Jamieson, Elie, seconded the motion, which was adopted. Mr Thomson, Edinburgh, seconded by Mr Russell, Cupar, moved that the directors' remuneration to 3lst March last be £500. Mr Alex. Murray, Edinburgh, said such a proposal would be all very well if they were getting a large dividend, but he though; they should feel something in their hands before they voted so large a sum. The Chairman said he had no wish at present to receive any money from the company, but it had been suggested that seeing that they had given a large amount of time to the interests of the company the shareholders might take up the matter, the directors had no wish to press the matter.- It was all the same to him whether they were voted anything for their services out of the prospective profits of the company or waited until the profits were realised. (Applause.) I might tell them, not by way of; boasting, that the directors had spent in the company's business two or three days a week during the past 15 or 16 months. Mr Murray thought the matter should be left over in the meantime. Mr Thomson said he adhered to his motion, The Chairman said the directors If I would not be warranted in accepting any kind of acknowledgement on the part of the shareholders unless they were perfectly,unanimous. Mr Murray said that if the chairman put it that way he would withdraw his motion. Mr Thomson said he thought it would be better, after what I had passed, that the matters should be allowed to stand in abeyance. (Applause.) On the motion of Mr Drysdale,Mr Robt. Prentice, Skedoway, Fifeshire, and Mr Win. Paterson, publisher, Edinburgh, were appointed directors. Messrs Lindsay, Jamieson & Haldane, C.A., were re-elected auditors at a fee of £40. A Shareholder asked if it was not time the directors were putting the shares on the Stock Exchange. The Chairman said the directors had had that question under consideration, and they had thought it more desirable not to do so, as the interests of the company might be made to suffer from hostile speculation. (Applause.) A vote of thanks to the chairman terminated the meeting.

The Glasgow Herald 29th August 1885

.......

1886 Annual General Meeting

The second annual general meeting of the shareholders of the Linlithgow Oil Company (Limited) was held yesterday afternoon in Dowell's Rooms, Edinburgh - Mr. Thomas Spowart, of Broomhead, presiding. There was a fair attendance. The Chairman moved the adoption of the report, recommending a dividend of 10 per cent. per annum, a summary of which has already been published. He said that since last meeting in August the directors had been going on with the completion of the works. The works had not been in full operation till January last, and he was happy to say that since that time everything had a been going on well and comfortably. Their products were giving every possible satisfaction. They had taken a place in the market equal to those of any other oil company. (Applause.) The accounts showed a credit balance of £6284 on the three months' working to 31st March last, and he thought that for an infant company that was not a discreditable state of matters. The costs continued to be moderate, and the work was going on steadily. The directors had set aside six per cent. for depreciation, and they thought that for a new work this was an ample allowance, when another company of very old standing only wrote off seven per cent. The proposed dividend was at the rate of 10 per cent. per annum, after carrying forward a sum equal I to £4568 per annum. The works to the extent of £45,000 had been insured, and the directors considered this amply sufficient.

Agents had been appointed in Ireland and England as well as in Scotland, and he believed they would have as good a chance in the market as their neighbours. Their lubricating and burning oils bad already taken a high standing. The capital expenditure up to 31st March had been £135,922, and he believed their works were very well worth the sum expended on them. They had £40,000 of uncalled capital to fall back upon, and they had their debenture borrowing powers untouched, so, he thought, financially they were in a safe and sound position. It was now a well-established fact that in regard to supply of shale they could compare favourably with any similar undertaking in the country. (Hear, hear.) - They had been developing the Broxburn seam for the last two years, and so successfully that they had a very large stock of shale lying on the ground. The two mines were now in a position to put out 800 tons a day whenever it was required. Just now they were putting out over 400 tons. During the two years they had not had a single trouble or difficulty in opening up these mines. (Hear, hear.) They had got to a depth of 50 fathoms. The shale was in a very good position for working, and it was of first rate quality. Then they had the Dunnet and other seams in the Champfleurie estate, close to the retorts and near the surface, ready to be opened up whenever required. The Ochiltree estate coal mine was putting out about 80 tons a day of coal of very fair quality. The refinery, which had been supplied with the most improved machinery, was capable of putting through 700 tons a day, which meant the production of 7,000,000 gallons of crude oil per annum when required.

The directors had carefully considered the subject of additional retorts, but they were not yet in a position to propose anything. As would be observed, they had leased the additional property of Kingsfield from the Earl of Hopetoun, which lay between the two detached portions of the Champfleurie estate. It had been of the utmost importance to secure this without waiting for a general meeting. The amount of obligation involved was very trifling, owing to the fair, reasonable, and honourable treatment of the Earl of Hopetoun's advisers. (Heat, hear.) Without this property the northern portion of the estate was quite locked up. They had negotiated for the very reasonable wayleave of one penny per ton. They hoped that the refinery would be entirely completed before the hot weather came. They had added three tanks capable of holding 100,000 gallons of oil each, and they were almost finished with another to hold 150.000 gallons. This would give ten tanks in all They were now producing 100,000 gallons of crude oil per week. In reference to the stocks in the balance-sheet, the directors had gone on the principle of putting them in at considerably under cost price. (Hear, hear.) They had been carrying on boring operations near the North British Railway for sometime past, and had discovered two of the most important Linlithgowshire seams of shale in the last bore,- close to the railway. (Hear, hear.) They were of unusually high and rich quality, and indicated that the other seams would all be found in the same portion of the estate. They had plenty of material already at present, but were none the worse of knowing what they still had. He would not enter at present on the general question of the present state of the oil trade and the depressed state of prices. They were a young company, and must look to the future. They must economise and make the best of their rich products. There was a great deal in their favour, and they must hope for better times. When those times came they would be in as good a position as any oil company in Scotland.

Mr William Paterson seconded the adoption of the report, and corroborated the statement of the chairman. When they came upon the market it was at the very worst season of the year, and unless their products had been exceptionally good they could not have shown the dividend they did. Up to the end of January their sales were a mere bagatelle, so that the dividend had really come during February and March. The subject of scale had largely engaged the attention of the directors. By far the greater portion of the company's sales was made up by the selling of scale. Scale was now selling at a price which he did not think had ever been so low, For the last 15 years the average price of scale had been three and a half pence. Now it was only two and a half pence and there were very few buyers. Therefore the directors were seriously considering whether they could not spend a little money in the refining or semi-refining of scale, in order that their margins might be increased. They would make a start certainly in a prudent way. (Applause.) Mr Gilmour, stockbroker, said that the candle companies were making very handsome profits, and that because they were getting their material at such low prices. (hear, hear.) He thought it would be a very good plan if their company could use their material themselves. The quantity was such that it would be a very great matter. If they could raise the price of their scale by refining it or making candles he found that a profit of 1d per lb. would bring something like an additional dividend of 10 per cent. The sum would be £15,000 or £18,000 if they could get a single penny per lb. more profits. He thought the directors should look into this matter of candle making.

The Chairman said the directors had been seriously considering this question. They were inquiring at the principal candle-works in the country, and they intended as speedily as possible to put their ideas into shape. They would not go into candle making on a large scale; they would creep before they walked. (Hear, hear.) The report was adopted on the motion of Mr Weir, the retiring directors, Messrs Andrew Landale and John Brownlie, were re-elected. The remuneration of the directors for the past two years was fixed at £750, and Messrs Lindsay, Jamieson & Haldane, C.A, Edinburgh, were re appointed auditors. A suggestion that a number of the shareholders who had never seen the works should pay them a visit was favourably considered. A vote of thanks to the chairman closed the meeting.

The Glasgow Herald, 5th June 1886

.......

1887 Annual General Meeting

The third annual general meeting Of the Linlithgow Oil Company (Limited) was held yesterday afternoon in Dowell's Rooms Edinburgh – Mr Thomas Spowart presiding over a good attendance of shareholders. The report of the directors showed that the balance at debit of profit and loss account, after deducing £11142 brought forward from last year, was £2434, and to this fell to be added £1470, amount of interest on debentures and bank overdraft.

The Chairman said – Gentlemen, we meet this year in altered circumstances for myself and my co-directors. I assure you that we regret these deeply. We have done what we could by painstaking attention to earn a fair dividend but the times have been against us. To enable you to thoroughly understand how this has come about, I would ask you to take a survey of the trade as it was three years ago when the company was formed, and compare it with what it is now. You will in this way be able to judge of the extraordinary changes, which have taken place, and how completely these have disappointed our expectations. From a trade journal for June, 1886, I have extracted the following:-" lubricating oil continues in good demand, but prices are unadvanced, and may he quoted as ranging from £7 10s to £9 10s f.o.b. for 885 specific gravity. The quotation (for burning oils) continues steady at 6d to 61/2d per gallon for finest No. 1 oils. Scales have been rather depressed during the month, and no large orders are reported. The general price is 3 ½ per lb." per lb." Taking the lowest of the figures, and proportionate prices for gas oils and scale, would give 15s 3d as the value of a ton of this company 's shale, after distillation and conversion into refined products; and if we add to this 2s 6d per ton for sulphate of ammonia, we would have in all 17s 9d per ton, Deducting from this the cost of manufacture, barrels, carriages, and other charges, which estimate at 13s per ton, there remains a profit of 4s. 9d per ton - sufficient for a dividend of 10 to 20 per cent, upon the paid- up capital of the company, after allowing for depreciation. I have quoted these figures to show that when this company was formed we had reasonable grounds for believing that it would yield good returns to its shareholders. Since that time, however, there has been a continuous reduction in values, and during the year now gone it has reached a point which places the whole trade in a very critical position.

The question here naturally arises admitting that prices are now very low, how was it that some other companies, having superior advantages, managed to pay dividends to shareholders? We have given a reply in paragraph IV of the report. Other companies have made con-tracts for scale at higher prices than were obtainable when we came into the market, and to this exclusively we attribute the differences revealed by the published balance-sheets. With regard to burning and lubricating oils and sulphate of ammonia, our prices will compare favourably with that obtained by our competitors. It is not desirable that the present state of affairs should continue -(applause) - as no company, however well situated, can hope to earn a fair return for the money and skill and energy which are involved, We find that when, by the discovery of more economical methods of distilling shale and refining oil, it is possible to produce marketable products at reduced costs, no advantage is reaped by the shareholders, each reduction being merely used to lower the general level of prices something should certainly be done to put an end to what every business man will admit is a foolish course. No doubt there is competition with America and Russia, and the refiners in Scotland must be prepared to face it. But not merely are we doing that which is an imperative thing, but we are fighting amongst ourselves in an altogether unnecessary way – (hear, hear)- and it is quite I possible for this to be modified, if it cannot altogether be removed. (Hear, hear.) Some months ago the directors of this company took part in an effort to bring about an understanding amongst the eight refining companies. It has been an open secret that a scheme formulated in November last would have been carried into operation with, I believe, very beneficial results, but for the failure to obtain complete unanimity. One of the objects of the scheme was the restrictions round of the output of scale if it were found that the supply was in excess of the demand, From statistics, which have been very carefully prepared, it is doubtful if any diminution of output is necessary. It is not a desirable thing to restrict production, as it is better for a work to produce as much as possible. Oncost and management charges remain practically stationary, whether the output is great or small, and these are proportionately less when spread over a larger quantity. Still it is better to keep production at or under the demand, and sell at paying prices, even although the costs are higher, than to sell under costs. It is to be hoped that ere long means will be found to bring about an arrangement to which all of the companies can agree. You may rest assured that your directors will do all in their power to establish a working agreement calculated to reinstate an important industry on a profitable basis. The expenditure during the past year has been considerably larger than would have been sanctioned if we had not thought that the depression was of a temporary character The demand for mineral oils and other shale products is rapidly growing, and will continue to grow, not merely in proportion to the increase of industrial and other communities, but because of the opening up of new markets, and the discovery of new purposes to which they can be applied. I do not rely much on what we hear frequently spoken of the exhaustion of the oil resources of America, these are practically inexhaustible, for fresh fields are being daily discovered, and there is little doubt that the supplies from that country could be greatly increased if profitable prices were obtainable. Still an examination of statistics from the wells shows that for some time there has been a diminution in the quantity of oil produced; while, in spite of a large quantity obtained from Russia, exports have increased and stocks have diminished. America just now is complaining quite as much as we do of the unprofitable nature of the business, and in this fact I see some hope for the future. I may refer to the fact that in March last a bill was introduced into the Pennsylvanian legislature for the purpose of preventing undue drilling, and consequent rapid exhaustion of oil districts. The bill was recently thrown out. Its existence, however, coupled with facts to which I need not now refer, is a proof of the severity of the struggle now going on, and which is not satisfactory to producers in America, Russia, or Scotland.

Along with my co-directors, I have carefully examined the position of this company. All that is wanted is a very slight advance in the value of our products, particularly of refined wax and candles; and we trust that advance will come. It so happened that when our works were completed the tide of prosperity was receding; but the flow will come again, and we are fully prepared to take advantage of it. With regard to the producing and refining of our oils, we are in a favourable position; and we have been able to introduce improvement in working which are giving beneficial results. The wax-sweating plant erected during the year is of a complete and satisfactory character. We are manufacturing candles on moderate scale, and shall increase it if we find it profitable to do so. This is probably the wisest course at the present time. We are converting all our crude scale into refined wax. It only remains for me to express a hope that the current year will show a decided improvement on the past. There are already signs of a better time, and I promise you that your directors will not fail to do whatever in them lies to secure the best possible results. (Applause.) I have now to move the adoption of the report and balance sheet.

Mr ANDREW LANDALE seconded the motion.

Mr SMITH, of Duloch, said he only held shares in this oil company, but he had rather been astonished in looking at the reports of the various meetings of other companies. He thought there had been a little want among the shareholders to strengthen the hands of their directors. The was no doubt, as the chairman had said, that it was an open secret as to the efforts that had been made to come to a better understanding among the companies. He was sorry that the majority of the companies had been frightened by the bugbear of one company refusing to join. He thought they should have gone on. He thought there was probability of a combination after the meetings of the companies had taken place. It might be said that they wished to create a monopoly but they did not want anything of the kind, They were entitled to get from the public a fair interest for supplying them with the products which they required.(Applause.) He did not think it was unreasonable that in companies such as this they should get 10 or 12 per cent (hear, hear) seeing the risk the company ran. The directors of the various companies should intimate to their managers that the latter were not fighting with their own money, but with the shareholders' money. If the managers could not get the thing to pay there should be other managers. (Laughter.) It would not be a bad thing for the managers of the various companies to meet occasionally and consult together. (Applause) The report was adopted.

On the motion of Mr ALEX THOMSON, Messrs Spowart and Prentice, the retiring directors, were re-elected. Mr PETER GLENDINNING moved that Messrs. Lindsay, Jamieson & Haldane, C.A be re-appointed auditors, and this was agreed to,

Mr HUGH GILMOUR said it would be well to hear what the company was doing at present, if they are able to meet the present price and if there was any profit. The CHAIRMAN said that for the last two months there was no loss. They had got a certain amount of increased products in various ways and by very strenuous application to economy and improvement he was happy to assure the meeting he would not say exactly that they had turned the corner, but he hoped they should soon do so, Mr GILMOUR said if they were exhausting the shale were they not working at a loss? The CHAIRMAN said that was inevitable- Mr FALCON KING asked if it would not be well to allow the works to stand a little. It seemed to be a pity to throw away 700 tons of shale a day. The CHAIRMAN said there were fixed charges royalties, rents, and so on to pay. Mr SMITH; That would be cutting off our nose to spite our face. The CHAIRMAN said he hoped the time would never come for any for any of the companies for considering the question of shutting up their works. The prospects of the trade might be gloomy, the temporary failure of negotiation might be unfortunate, but the directors had the strongest hopes that the negotiations would be revived ( Hear, hear.) Now that all the companies were learning a lesson in the school of adversity, they would be brought round to consider matters in a more businesslike way and they would apply themselves to keep up the prices, just as railway companies, insurance companies, and traders of every description had come to an arrangement of sort. There were only eight refining companies in Scotland, and why should they not meet like businessmen, and the public would never know it by a sixpence.

After some conversation, a suggestion by Mr. KING was our into the form of a motion and agreed to namely "That the shareholders of this company wish to impress on the directors the necessity of this board doing all in their power to come to a reasonable, business-like agreement with other companies as to prices, so that there be no undue and unnecessary competition betwixt ourselves, resulting in the throwing away of possible profit and the shareholder's money. A SHAREHOLDER asked, was it the case, as stated in the Herald, that negotiations had been going on again and that they had ceased again? Had the chairman any knowledge as to that? The CHAIRMAN said the directors had reason to believe that that was a somewhat premature statement. Hitches had occurred, but there was nothing very serious as to prevent, after all the meetings were over, the negotiations being resumed. On the motion of Mr ROBERT COX, the directors', remuneration for the past year was fixed at £500. The CHAIRMAN, said the board were very much gratified by such an expression of confidence in such very discouraging circumstances. The directors would not accept the money till profits were made – (applause) – and in the meantime it could be carried forward to their credit. A vote of thanks was awarded to the chairman, and the meeting ended.

The Glasgow Herald 4th June 1887

.......

1888 Annual General Meeting

The fourth annual general meeting of the shareholders of the Linlithgow Oil Company (Limited) was held yesterday in Dowell's Rooms, George Street, Edinburgh. Mr T. Spowart, chairman of the company, presided. The directors' annual report, the substance of which has already been given in this column, was held as read.

The CHAIRMAN said that when he addressed the shareholders at their last annual meeting it was a time of great depression in the oil trade. There were symptoms of improvement, but these were so faint that it was impossible for anyone who wished to look facts fairly in the face to derive much comfort from them. It was probable that the disappointment at the result of the year's operations, which, in common with his co-directors, he could not but feel, found expression in the language he then used. He was glad to be in a position to state that the oil trade was in a much more satisfactory condition now than it was a year ago. Prices all round were higher and were likely to remain so; and in addition to this the whole of the oil companies in Scotland were acting together in a rational way for the general good. They might remember that at their last meeting he referred to a scheme which had been formulated by the Scotch companies, but which, from lack of unanimity regarding the method to be adopted, bad broken down. What they then considered to be a possible, but not very probable thing, had been accomplished, arid he could safely say that never since the oil trade began had there been anything like the helpful co-operation between rival companies which existed today (applause.) It had not been easy to reconcile what seemed conflicting interests, and to produce a feeling of mutual trust and confidence, but yet it had been done; and the directors believed that what was for the good of the trade generally would be also for the good of the shareholders generally. (Applause.) He then went on to refer to negotiations which had been conducted with the representative of the oil producers of the United Stales, which had resulted in an agreement regarding prices of scale and wax: and, perhaps, of even more importance, resolutions regarding restriction of production of these articles, if found to be necessary. To the American representative, Mr Bedford, was also due in large measure an agreement which had been signed by nearly all the candlemakers in the United Kingdom, by which they expected the trade would be placed in a more satisfactory position than formerly. So far as they had gone, results had been satisfactory, and he believed they were now strong enough and united enough to pursue the new policy against any opposition should it ever be brought against them. The leading feature of the agreements between the American and Scotch producers as to scale and wax, the Scotch producers or oil, and the candlemakers of the United Kingdom, - was that while fixing and regulating minimum prices, these were not to be put so high as to risk decrease in consumption -(hear, hear)- not only to ensure a fair margin of profit for the capital invested in the companies.

Speaking of the position of their own company, the Chairman said that perhaps some of them were disappointed with the result of the year's operations. It was quite normal that they should be. A good deal had been said in the newspapers about a revival of trade and particularly about higher prices for shale products. lt was not, however, possible all at once for any company to get much advantage from a rise in prices. To carry on a large work; such as theirs it was necessary to sell a good bit less. An advance therefore could only, as a rule, come into operation when existing contracts were worked off. Last year they acted on the principle of selling as little as they could for forward delivery but still it was really only during the last quarter, from January to March, that they obtained any advantage. They were probably aware that during July, August, and September the works were idle owing to a strike of the miners against a reduction of wages; and as it was during that period that the demand for all classes of oil set in, they were not in a position to meet the market for some time. They lost a good deal both directly and indirectly through the strike. They felt it necessary, however, to set with the Scottish Mineral Oil Association who had resolved to effect a reduction in wages, which, in the then position of affairs, none of the members could afford to pay. What the indirect loss was from such a prolonged struggle it was difficult to estimate, but they knew that it was considerable. He trusted they should not have any more disputes with their workmen. They wished to pay the men fair wages, and to be on good terms with them. In periods of depression, such as they had last year to pass through, it was necessary to practice the most rigid economy, and they felt it imperative to take off advances which had been granted in times of prosperity. Taking these circumstances into account, they had no reason to be unduly dissatisfied with the result of the year's operations. He was confident that should the prices they had been recently getting -low though they were compared with those obtained two or three years ago - continue, they should have a much more satisfactory report to submit to them at their next meeting. (Applause.)

One great improvement which had materially helped them was a large increase in the yield of sulphate of ammonia. While during 1887-88 the company distilled nearly the same quantity of shale as during 1886-87, the total output of sulphate of ammonia was 472 tons more. This gave an increased income of fully £5,000. They were in hopes that they should be able during the current year to obtain an additional yield, but he could not speak definitely as to this, The company had been engaged for some months in sinking a mine into the Dunnet seam of shale, and he was a glad to say it was of excellent quality and full thickness. They might have charged a portion of the expenses of so doing to capital, but it was considered better that the whole should be borne by revenue. The directors had been very unwilling to add to capital account, and nothing had been sanctioned which did not obviously appear to be necessary. He did not expect that during the current year any large expenditure would be required. The company should require to provide additional machines for the candle department, but these were not costly. The outlay incurred in connection with the refining of scale and candlemaking had been very moderate. They were in a position to refine the whole of their scale into wax, and with extra machines make the whole of the wax into candles. They hoped to do a large business in this department during the coming season. The general condition of the works was in every way satisfactory. He was satisfied that all that they required to make the company a great success was a period of good prices, such as were obtainable prior to le 1887. These could not be commanded at will, but, he was not without hope that ere long they should see a still further improvement. (Applause.) The Chairman concluded by moving the adoption of the report. Mr ANDREW LANDALE formally seconded the motion, which was unanimously adopted.

Questions having bean invited, the CHAIRMAN, in reply to a Shareholder, said the average of prices was much the same since the improvement which took place in January, February and March, but he was happy to be able to tell them that the month of April was quite satisfactory. If the Scottish Mineral Association held firmly together, faithfully and loyally, if each company considered the general good of the whole trade and let to itself alone, those prices would be maintained, and he believed increased. (Hear, hear, and applause.) Another SHAREHOLDER – If these prices are maintained, what will be the result next year? (Laughter.) The CHAIRMAN said he could hardly answer that question. Did it mean what dividend would be be paid? The SHAREHOLDER - Would you pay any dividend? The CHAIRMAN - Oh, certainly. he hoped and the board hoped and believed that the result of this year's operations would result in something quite satisfactory to the shareholders. (Applause.) Mr COX moved, and Mr J. D. WALKER seconded, the re-election of the retiring directors- Messrs. Landale and Paterson - which was unanimously agreed to. Mr. SMITH moved a vote of thanks to the directors for their services. He was sure all the oil companies of Scotland had to thank their board for the initiation of the step that had been taken, and for the trouble which the board had taken in carrying it out. All the companies were deriving benefit from it, and he thought they had recognised this in choosing their chairman as chairman of the united companies. He considered that was a very great honour which had been conferred on the company. (Hear, hear.) The CHAIRMAN, in replying, said the agreement had brought about a remarkable improvement already to the trade and he hoped it would continue. Everyone seemed determined to preserve the association, and he hoped that good would come of it, and that all the companies would benefit in another year to a large extent from its operations. (Applause.) The proceedings then terminated

The Glasgow Herald, 26th May 1888

.......

1889 Annual General Meeting

The fifth annual general meeting of the shareholders of this company was held in Dowell's Room, Edinburgh, yesterday – Mr Andrew Landale, chairman of the company, presiding. In a report, a summary of which appeared in the Herald of the 11th May, was held as read. The Chairman, in moving the adoption of the report, expressed regret that a dividend could not be declared. They had fallen short of the results requisite for this purpose, and so far had not done so well as some of their competitors. Why this should have been so was a question not easily answered. They had reduced the price of certain products, and had also obtained ?? during the preceding year, in every respect they had improved, and their financial position was healthier than when they ?? little more economising and a very small increase in market value of their products would make a substantial difference in the profit and loss account. An analysis of the accounts for last year showed that their ???? a quantity of shale. The quality of oil obtained from it did not bear ??? the experts who tested it . As ??? they had obtained a large yield of sulphate of ammonia and it was their opinion that the yield could be considerably increased. As the shareholders were aware, the ?? of the retorts used by the company were of the Henderson design and they were not the most suitable for ammonia recovery. They might perhaps produce a better quality of oil, but the net result was not favourable. In the present market it was more profitable to obtain increased sulphate of ammonia, even although this may sacrifice a small percentage of oil scale. It was calculated that the alteration of retorts would cost about £5,000. The work was to the done gradually, but expeditiously as possible. The directors had made representations to the proprietors of the shale that the royalties were excessive and not justified by its quality. They had been offered a reduction in royalty of 2d per ton for 2 years, but they were thankful? For the concession, they pointed output? A reduction of double this amount should be made, since if this was allowed the company would still be paying full value. Other companies were paying no more than they had asked to be reduced tom while others had assigned reductions in consequence of the depreciation in prices that had occurred . H assured the company that directors were doing all in their power to bring prosperity to the company. They had shown their ??? ??? by taking up unissued debentures amounting to £5000. Since the accounts were made up they had had to redeem £4300 debentures which fell due at Whitsunday. They urgently recommended these to be replaced by the shareholders. Mr J. BROWNLEE seconded. The CHAIRMAN replied to a number of questions. He said that at present the company was getting 33lb of sulphate of ammonia for a ton of shale but expected by the proposed alteration to get 50lb. Mr DAVID GILMOUR expressed disappointment with the report He said there was something wrong which it would be advisable to find out. He therefore move that a committee of shareholders be appointed to confer with the directors on the affairs of the company and report back to a future meeting. Mr JAMES LINDSAY seconded. The CHAIRMAN said that the directors would welcome such an enquiry. Mr Gilmour's motion was adopted and a committee of five gentlemen nominated. The appointment of Mr. Drysdale to the directorate was confirmed and Mr Shaw was elected to the remaining vacancy. The report was approved and the proceedings terminated.

The Glasgow Herald, 25th May 1889

.......

1890 Extraordinary General Meeting

An extraordinary general meeting of the Linlithgow Oil Company (Limited) was held yesterday afternoon in Dowell's Rooms, Edinburgh- Mr Andrew Landale presiding. There was a fair attendance of shareholders The meeting was called for the purpose of receiving the report by the shareholders' committee appointed in May last and of considering special resolutions based thereon.

Mr EDWARD BRUCE, convener of the shareholders' committee, submitted the report, and said the committee had done their very utmost to give a true and accurate account of the present position of the company. The inquiry had been somewhat protracted, but it had been thorough and complete. It was pointed in the first place to the thorough nature of the investigations of Mr Wm. Fraser of the Pumpherston Oil Works, who had assisted the committee, and to the satisfaction expressed by that gentleman as to the extent of the shale field its freedom from faults, and the convenience with which it could be worked. As a shale field, apart from the quality of the shale, Mr Fraser said he had never seen its equal. The refinery was admirably adapted for the work, and the wax-refining departments were laid out with care and economically handled. The commercial department was conducted most efficiently, and had gives satisfaction to the committee. The erroneous estimate of the character of the shale had led to all the misfortunes of the company. Less ammonia been got from the shale than might have been swing to the Henderson retort having been used. This retort was adopted because at the first the shale was understood to be richer in oils and not so rich ammonia, whereas the reverse was now found to a be the case. The retort most suitable for the shales was the Young & Beilby. As to the future there was a very large area of shale to be worked which would meet all requirements for many years. The present difficulties with the miners and the high price of coal were, in the opinion of some, not likely to continue, and there was a prospect of improvement in the oil market. He was therefore of the opinion that the shareholders should be loyal to the company, and that they should take up a proposed debenture stock. (Applause.) By doing this they would protect their own interests, and put money in the lands of the directors to erect additional and improved retorts, which would keep the refinery and whole works in full operation. If this was done, he was convinced that the shares would soon become of the market value of £5 10s, which was the value it was proposed to reduce then to, for the company would become a very strong dividend-paying one. (Applause.) He also expressed the strong sense of the indebtedness felt by the committee to one of their number, Mr J. D. Walker, both for investigating the affairs of the company and in preparing the report. He further called attention to the good work done by Mr Fraser in the same direction. On behalf of the committee, be thanked the If directors for their cordial co-operation and assistance In conclusion, he called attention to the fact that there was one portion of the shale field yet unworked which was believed to be very rich in oil. It could not be opened until the shareholders provided the money, but it was the opinion of competent persons that that was the best part of the field. As it was rich in oil, the Henderson retorts already in possession of the company might be used for retorting that shale.

The CHAIRMAN expressed regret at the unavoidable delay in presenting the report of the committee. He spoke of the work of investigation, and of the proprietors of the lands having agreed to a reduction of the royalties on the shale won. The conclusions the committee had arrived at were identical with those stated in the report last year. It had been established beyond question that by using I the Young & Bielby retort there would be an increase of profit to the company of 1s a ton. The directors were unanimously of opinion that the committee's proposal to erect new retorts of the Young & Bielby pattern was not only the best course, but it was the only one open. There was probably no other company in Scotland that could put shale into the retorts at a lower price than the Linlithgow Company could. The candle factory promised to use up the whole scale manufactured in the works. The new benches of retorts would bring up the yield of crude oil to over 6,000,000 gallons which was the maximum quantity that could be dealt with by the refinery. The writing down of the capital would, he trusted, commend itself to every shareholder. The directors had so much confidence that though their aggregate holdings were large they had determined to take up the whole of their proportion of the new shares. Some of the larger shareholders had intimated their intention to do likewise, and to take any additional new shares that might be left unsubscribed for. The payments would probably be arranged to extend ever a year. In regard to suggestions that the directorate might be strengthened, the directors had already approached two of the largest and most influential shareholders with the view of getting their consent to join the board. (Applause.) He moved that the report be received, and that the committee be thanked for their labours.

Mr BRUCE said he would add to what he had previously said that the committee had not taken a sanguine view of the position, but had fixed their estimate as loss as possible. Mr HUNTER, who had been engaged in connection with the original testing of the shale, complained that the present report cast reflections upon him. The meeting, however, expressed itself unwilling that he should proceed, and he said that if that was so he would bring out the facts in a Court of justice. The general opinion of the meeting, however, was that no reflection had been cast upon him, and that the business now was to deal with the present state of matters, and not to resuscitate questions as to the original shale-testing, Mr HUGH GILMOUR, a member of the committee, said they had taken their estimates of the profits at the minimum ; everything had been cut down to the lowest, He believed there would be another saving, which the committee had not taken into account at all - namely, that considerably less coal would be needed when the Young & Beilby retort was used. Coal was a very large item, something like 50,000 tons, and if they could save a third, or something like that, it would be a great matter. He also spoke of the desire, which a large body of the shareholders had, that Sir Charles Tennant should accept the position of Chairman of the company

Sir CHARLES TENNANT said the request was one which he could hardly entertain. He thought the statements in the report and those made by Mr Bruce ought to inspire confidence in the shareholders. a. The statements looked extremely trustworthy and encouraging. Being a large shareholder, he would do his part and take up all the new stock adhering to his holding - (applause)- and he thought a good many of the large shareholders would follow his example. They had very good security - better than in a great number of companies. He saw nothing in the affairs of the company to make one despondent, and the present had a great number of a good features. He would be very glad to do all he it could in the interests of the company - (applause) - but he was afraid he had got too many things on hand already to allow him to join the board. He therefore could not see his way at present to accept the invitation. Mr SMITH of Duloch seconded the chairman's motion, and expressed the hope that Sir Charles Tennant would reconsider his decision.

The CHAIRMAN assured Sir Charles Tennant that. his acceptance of the chairmanship of the Board would be considered a very great favour, and every effort would be made to make his work as light as possible. He hoped Sir Charles would think over the matter before he was approached in s a more formal way. Mr SMITH said he understood the company ware intending to remove their offices to Glasgow, and that would be an additional inducement to Sir Charles Tennant. The motion was then adopted. The following special resolutions were then moved seriatim by the CHAIRMAN, seconded by Mr BROWNLIE, and unanimously agreed to: "that the capital of the company be reduced from 20,000 shares of £10 each, £8 paid, to 20,000 shares of £7 10s each, £5 10s paid." "That £50,000 mortgage debenture stock be created, bearing interest at 6 per cent. per annum convertible at any time, in the option of the holders, into ordinary shares of the company at par, and to be redeemed after 1892 to the amount of at least £2503 per annum by annual drawings at premium of 5 per cent" "That in order to carry out the foregoing proposal 9031 ordinary shares of £7 10s each will be created". . A vote of thanks to the chairman closed the meeting. A deputation representing a large number of Shareholders afterwards waited upon Sir Charles Tennant to urge him to accept office, and after conference Sir Charles intimated that he would consider the matter.

The Glasgow Herald 9th April 1890

.......

1890 Annual General Meeting

The sixth Annual General Meeting of the Linlithgow Oil Company Limited, was held in Dowell's Rooms Edinburgh, yesterday - Mr John Brownlee, Dunfermline, presiding, in the absence, through ill-health, of Mr Lansdale, the chairman of the company. The CHAIRMAN, in moving the adoption of the report, which has already been published, said - I am sorry that the result of operations during the year ending 31st March has not been satisfactory. These have been lightly touched upon in the report. I may mention, in supplement to what I there stated, that the case of the loss sustained was not so much the rise in wages or the increased cost of material, but the small throughput of a shale. During the preceding year we made from our own retorts about 4 1/4 million gallons of crude oil, and we refined in addition three-quarters of a million of gallons bought from another company. During the past year the total quantity dealt with was only 3 1/2 million gallons. The consequence of this diminished throughput was, as can be easily understood, increased costs all round. We have also certain fixed charges -outlays in connection with our private railway, anti-pollution taxes, interest, general management and commercial department - amounting to about £10,000 yearly, and these when divided by a small production compare unfavorably with a period when the refinery was more fully employed. The difficulty which faced us about September of last year, when the rise in coal took place, and when miners were able to obtain better wages in coal pits than we would have been justified in paying, was the small stock of shale on hand. We had been compelled to keep down the output at a time when it might have been easily increased. For at least six months of the year we were unable to keep the whole of the retorts in operation, and even those which were nominally working were very imperfectly supplied with shale, I mention these circumstances to show that the outcome, as some may have supposed, was not due to any permanent and unalterable cause, but to temporary difficulties which we believe are now at an end. The response of the shareholders to the request of the directors for additional capital has entirely changed the aspect We are now able to stock shale against the recurrence of a period similar to what we have recently passed through, and we are also able to erect retorts better suited to the shale with which we have to deal, and to carry out other much needed improvements. By reason of the reduction of capital we are enabled to write of the whole of the balance against us, and to carry on the business with greater economy and on a more extensive scale. Contracts have been. made for the erection of two additional benches of Young end Beilby retorts, and operations are in progress for the alteration of one of the existing benches of the Henderson retort. These will be completed within four months from this date, and the additional sulphate of ammonia obtainable will prove an important source of revenue. Provision has been made for a supply of crude oil from the outside.

You are aware that Sir Charles Tennant, who has agreed to accept a seat at the board - and to whom we area greatly indebted for the success which has attended the somewhat difficult financial arrangements just concluded - expressed desire to have on the board a gentleman practically acquainted a with the oil trade. As a result of that expression of opinion Mr Fraser, managing director of the Pumpherston Oil Company, who is thoroughly conversant with the affairs of the company, and who is sanguine of future success, agreed to act as adviser to the board. We have stated in the report that the mineral proprietors have agreed to a reduction of the royalties. As soon as they clearly understood the character of the shale and that the lordship per ton was in excess of the market value they willingly agreed to make concessions which will materially help us in the future. There is one point yet which we have brought under their notice, and we have no doubt that a proper apprehension of the importance of the liberty asked for will bring about a satisfactory solution of the difficulty. For some time, as you are aware, the Scottish oil trade his been in a depressed condition. The competition with Russia and America has been very keen, and the prices obtainable for all products have been reduced almost to the vanishing point. But this year the downward movement has not only been arrested, but has, in at least one important produce, scale, very decidedly improved. The stock of this article both in America and in Scotland has been reduced so much that it is extremely doubtful if the supply, added to the production from all the works, will prove equal to the demand. By an agreement with the candle-makers of the United Kingdom, in conjunction with the refiners in America and in Scotland, the price has been raised nearly £5 per ton, and this means to our company an additional revenue of about £10,000. That in itself is a most important change. But it has had another effect. Hitherto we have had great difficulty in disposing of our candles, but up till now the sales for the coming season have greatly exceeded our expectations. With regard to lubricating and gas-making oils the outlook is also hopeful. Prices have advanced in both cases, and while the increased revenue from these articles is not so great as from scale, yet it is important. The only element of weakness at present is burning oil, which in the opinion of some may not realise quite so good a price as it did last year. You will find in the report that boring operations are in progress in Little Ochitree, where; it is hoped the Broxburn seam of shale may be found in better condition than it is on the rest of the property. I am not yet in a position to state the result, but we expect in a few days to have definite information. The directors are not depending upon the discovery of a better seam. The calculations that have been made are based exclusively on results already obtained. If the Broxburn shale is found in better form the company will be of course benefit, but if not we are not going to be greatly disappointed. It is our intention by and by to remove the offices of the company from Edinburgh to Glasgow. This will be more convenient in several respects, and will bring us closer contact with the principal buyers in the oil trade. (Applause.) Mr R. R. PRENTICE seconded, and the report was adopted.

The Chairman then moved, and Mr HUGH GILMOUR seconded, the election as a director of Sir Charles Tennant, which was unanimously agreed to. Sir CHARLES TENNANT, in thanking the meeting, expressed himself sanguine of the ultimate success of the company. He thought they had turned the corner, and saw nothing in the outlook to make them distrustful of the future. He entered upon the duties of director in a very hopeful spirit. Messrs Landale and Prentice were then unanimously re-elected directors of the company, and the proceedings terminated with a vote of thanks passed to Brownlie for presiding.

The Glasgow Herald 24th June 1890

.......

1891 Special General Meeting